In a world where digital payments have become the norm, detecting credit card fraud has become increasingly complex. The more transactions, the more data to analyze for our fraud detection software. And the bigger the datasets — we’re talking millions of legitimate transactions for one fraudulent one — the harder it is to find cases of fraud.

Luckily for us and our bank accounts, uOttawa’s Bahar Emami Afshar, a computer science master’s student, is tackling this challenge with advanced machine learning techniques.

“Credit card fraud has become a critical issue in today’s world with the rapid growth of e-commerce and online transactions,” she explains. “What makes addressing it even more urgent is that this type of fraud is often tied to broader illicit activities, such as identity theft and money laundering.”

Detecting anomalies in large datasets

Training fraud detection tools to identify suspicious activity usually involves feeding them large amounts of labelled data that includes past examples of fraud so the systems learn what to look for. Manually labelling this data takes time, money and domain expertise.

For her master’s research, Afshar has developed a new method to identify fraudulent transactions among unlabelled datasets using advanced machine learning techniques. Her project, known as ITERADE (ITERative Anomaly Detection Ensemble), is a novel unsupervised machine learning tool designed specifically for the financial sector.

“We work with a company that receives raw data from clients, often without any labels, which makes identifying fraudulent cases particularly challenging,” she says. “The objective of ITERADE is to help prioritize labelling efforts in a way that maximizes the detection of fraudulent cases.”

ITERADE takes an iterative, multiple-model approach to anomaly detection. It identifies both suspicious cases — those likely to be fraudulent — and “safe” cases that exhibit normal behaviour. This dual output gives domain experts a head start in investigating the right data, making the labelling process more efficient and impactful.

The result: Improved fraud detection

Compared to traditional methods, ITERADE significantly enhances the likelihood of identifying fraudulent transactions. Afshar and her collaborators have seen fraud detection rates 3 to 15 times better than those for previous tactics.

The algorithm developed by Afshar uses artificial intelligence to make the labelling process much more efficient for analysts. This is particularly useful in cases where the dataset is extensive but contains very few instances of fraud.

“The tool serves as an effective starting point for experts, allowing them to label and inspect suspicious cases more strategically,” Afshar explains.

Its ability to identify safe, low-risk transactions also helps researchers better understand what “normal” transactions look like, making the differences between legitimate and fraudulent behaviour clearer over time.

A tool for more than finance: Exploring health care, cybersecurity and infrastructure

“In the research community, ITERADE introduces a novel unsupervised anomaly detection approach, which shifts how we address highly imbalanced datasets. It provides a flexible, budget-agnostic framework that outperforms existing methods in fraud detection and sets a new standard for handling other imbalanced classification problems in an unsupervised manner,” says Afshar.

Looking ahead, the team is also working to integrate ITERADE into an active learning framework. As more labelled data becomes available, the system will evolve to use both supervised and unsupervised methods, further improving its performance.

Afshar sees a future where AI tools like ITERADE can be used to solve challenges far beyond finance. Health care, cybersecurity and infrastructure monitoring are just a few areas where rare but critical anomalies need to be detected.

Afshar says that she hopes she can eventually apply her AI and machine learning expertise across multiple domains. “I’m excited to pursue a career that combines AI and engineering to tackle complex real-world problems,” she explains. “I aim to contribute to cutting-edge AI applications that improve decision-making, security and overall quality of life across various industries.”

Technology for digital transformation of society, a uOttawa Engineering priority

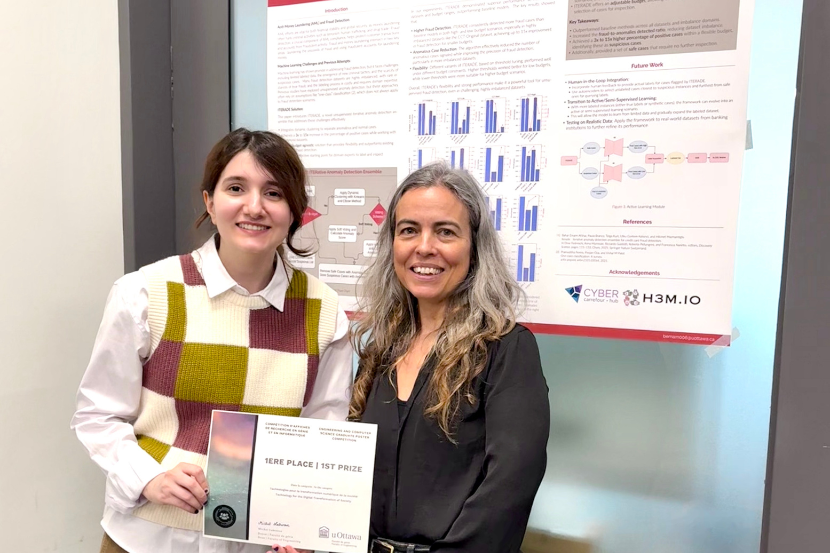

Afshar developed her project in the uOttawa-IBM Cyber Range under the supervision of Professor Paula Branco. She also collaborated with industry partner H3M Analytics Inc.

She was awarded first place in the Technology for Digital Transformation of Society category at the 2025 Engineering and Computer Science Graduate Poster Competition. It was held during Engineering Research Celebration Day at the Faculty of Engineering.

Faculty of Engineering research on technology for the digital transformation of society focuses on developing and applying digital technologies — such as AI, cybersecurity tools and data systems — to improve how we live, work and connect in an increasingly digital world.

Discover other winning projects from the graduate poster competition.