Campus life

Start your journey here!

Student essentials

SOS Immigration

Weekly virtual Q&A sessions to answer your immigration-related questions regarding your temporary residence on Wednesday or Thursday from 10 a.m. to 1…

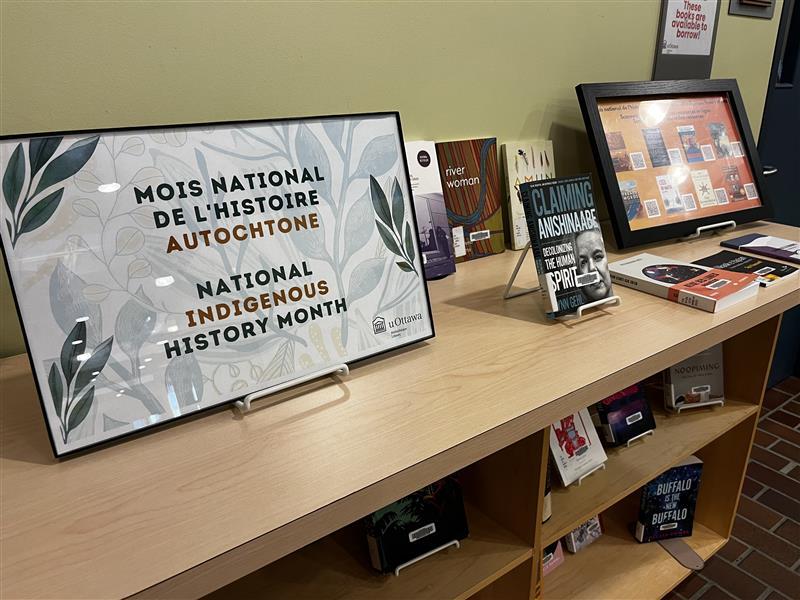

National Indigenous History Month!

June is National Indigenous History month. We honour the heritage, cultures, contributions, and resilience of First Nations, Inuit, and Métis peoples.…

Celebrate Pride Month at the Library

June is Pride Month! At the Library, we're celebrating the 2SLGBTQI+ community with a vibrant display of books and resources at the Morisset Library.…

Students with extraordinary summer plans

3 quick tips for finding work on campus

2024 Co-op Student of the Year Awards

Each year, the faculties, the Office of Graduate Studies, and the Co-op Office select outstanding co-op students to receive a …

Your campus in Canada’s largest tech hub

Additional information

Get in touch

We're happy to help!

We’ve got contact information for faculties, services and more. Take a look and find what you need.

Student ambassadors

Are you a future student looking to speak to someone who's been in your shoes? Do you just want more up to date information and resources?

Check out our social media to connect with our student ambassadors.